mobile money

Posted by on Nov 18, 2011

Editor's Note: This guest post is by Janet Gunter, a anthropologist and blogger, an ex-“aid worker” interested in communication, technology, and new economies. She is currently working as an adviser at @Verdade newspaper in Maputo, Mozambique.

Mobile money arrived in Mozambique earlier this year, after the larger of the two mobile operators, the state-owned mcel, rolled out a service called mKesh (close in pronunciation to mCash). mKesh “soft launched” the service in 2009, but has intensified its efforts this year, with an official launch in September. The service now claims to have 41,000 registered customers and 2,700 agents across the country.

So far, however, the story of mobile money in Mozambique is a cautionary tale which provides clues about the adaptability of the lauded operator-led model.

Like with mPesa, Kenya’s Safaricom-led service, mcel’s 4 million plus subscribers can use the service, creating a “mobile wallet” which is designed to be used to collect cash from participating agents and make payments.

| It's not yet mPesa: mKesh, Mobile Money in Mozambique Is Slow To Take Off data sheet 1211 Views |

| Countries: |

Mozambique

|

Posted by MarkWeingarten on Nov 18, 2011

The Mobile Financial Services Development Report 2011 data sheet 667 Views

Abstract:

The Mobile Financial Services Development Report 2011 assesses the development of the mobile financial services (MFS) ecosystem in twenty countries. Its purpose is to provide a tool for decision makers to identify relative areas of strength and weakness and to prioritize opportunities for collaborative action to build scale in mobile financial services. The Report defines mobile financial services development in terms of the key drivers across the institutional, market and end-user environments that lead to adoption and scale. Measures of mobile financial services development are captured across seven pillars:

1. Regulatory proportionality

2. Consumer protection

3. Market competitiveness

4. Market catalysts

5. End-user empowerment and access

6. Distribution and agent network

7. Adoption and availability

The Report thus takes a comprehensive view in assessing the factors that contribute to the long-term development of mobile financial services. It includes mobile payments and transfers within its scope but also the development of other vital financial services such as savings, credit, and insurance.

Posted by EKStallings on Nov 11, 2011

Zap It To Me: The Short-Term Impacts of Mobile Cash Transfer Program data sheet 610 Views

Author:

Aker, Jenny C., Rachid Boumnijel, Amanda McClelland, Niall Tierney

Abstract:

Conditional and unconditional cash transfers have been effective in improving development outcomes in a variety of contexts, yet the costs of these programs to program recipients and implementing agencies are rarely discussed. The introduction of mobile money transfer systems in many developing countries offers new opportunities for a more cost-effective means of implementing cash transfer programs.

This paper reports on the first randomized evaluation of a cash transfer program delivered via the mobile phone. In response to a devastating drought in Niger, households in targeted villages received monthly cash transfers as part of a social protection program. One-third of targeted villages received a monthly cash transfer via a mobile money transfer system (called zap), whereas one-third received manual cash transfers and the remaining one-third received manual cash transfers plus a mobile phone. We show that the zap delivery mechanism strongly reduced the variable distribution costs for the implementing agency, as well as program recipients’ costs of obtaining the cash transfer. The zap approach also resulted in additional benefits: households in zap villages used their cash transfer to purchase a more diverse set of goods, had higher diet diversity, depleted fewer assets and grew more types of crops, especially marginal cash crops grown by women.

We posit that the potential mechanisms underlying these results are the lower costs and greater privacy of the receiving the cash transfer via the zap mechanism, as well as changes in intra-household decision-making. This suggests that m-transfers could be a cost-effective means of providing cash transfers for remote rural populations, especially those with limited road and financial infrastructure. However, research on the broader welfare effects in the short- and long-term is still needed.

Posted by ccarlon on Oct 12, 2011

Mobile Communications in Zambia data sheet 707 Views

Abstract:

This report uses AudienceScapes data from a nationally representative survey of Zambia to focus on how people of various social groups access and use mobile communications. The report also showcases how the AudienceScapes survey data can help members of the development community to design and implement more effective programs in technological access, communications and information empowerment.

Beyond measuring basic access and use levels, this report works to answer several key research questions regarding the role of mobile phones in economic and social development in Zambia. These include but are not limited to; what is the potential for SMS-based information services as a development tool, is the mobile market beginning to reach disadvantaged parts of the population, what are the continued barriers to mobile phone access and use, who is using mobile money and is their greater market potential for these services?

Posted by EKStallings on Oct 04, 2011

Dial "A" for Agriculture: A Review of Information and Communication Technologies for Agricultural Extension in Developing Countries data sheet 1395 Views

Abstract:

Agriculture can serve as an important engine for economic growth in developing countries, yet yields in low-income countries have lagged far behind those in developed countries for decades. One potential mechanism for increasing yields is the use of improved agricultural technologies, such as fertilizers, seeds and cropping techniques. Public-sector programs have attempted to overcome information- related barriers to technological adoption by providing agricultural extension services.

While such programs have been widely criticized for their limited scale, sustainability and impact, the rapid spread of mobile phone coverage in developing countries provides a unique opportunity to facilitate technological adoption via information and communication technology (ICT)-based extension programs.

This article outlines the potential mechanisms through which ICT could facilitate agricultural adoption and the provision of extension services in developing countries. It then reviews existing programs using ICT for agriculture, categorized by the mechanism (voice, text, internet and mobile money transfers) and the type of services provided. Finally, we identify potential constraints to such programs in terms of design and implementation, and concludes with some recommendations for implementing field-based research on the impact of these programs on farmers’ knowledge, technological adoption and welfare.

Posted by ccarlon on Sep 20, 2011

The Development of Mobile Money Systems data sheet 1326 Views

Author:

Flores-Roux, Ernesto and Judith Mariscal

Abstract:

In this paper we argue that mobile banking offers the opportunity to diminish the financial exclusion suffered by the poor by offering access to credit and to savings which are key tools capable of transforming the livelihoods of the poor as well as the efficiency of the market. However, mobile phones need a complete ecosystem that supports its application to a functioning mobile banking service.

The aim of this paper is to contribute to existing knowledge of mobile money across the value chain by providing insight into the mechanisms of m-money, the value propositions within the business of m-banking and what is preventing its swifter adoption and usage in the developed world. We develop a taxonomy of the key drivers of the business model which provides insights for assessing the replicability of these models in other countries. We focus on models developed in Kenya and the Philippines and explore what is lacking for a widespread adoption in Latin American countries, such as Mexico, in order to observe what is preventing the creation and usage of m-money models for the BoP.

Posted by AnneryanHeatwole on Sep 06, 2011

And, we are back! Today's Mobile Minute brings you coverage on cross-platform mobile messaging, increased network usage rates for MTN Uganda subscribers, strategies for implementing mobile money programs in post-conflict/disaster areas, and a demographic breakdown of U.S. smartphone users.

- ChatON, a new, cross-platform mobile messaging service from Samsung, brings texts, group chats, and multimedia sharing to a variety of handsets and operating systems. According to Samsung, the messaging service will work on both feature phones and smartphones, and will operate on a variety of platfroms including Android, Apple, and RIM/BlackBerry.

- On September 1st, MTN Uganda announced an increase of up to 100 percent of their network usage prices. The International Business Times reports, "MTN has increased the rate it charges customers for calls to another network by a third to 4 shillings a second while those for calls across its own network will double to 4 shillings. The changes take effect this weekend." The company says this was done to account for an increase in operating costs and as a response to inflation in Uganda.

Posted by AnneryanHeatwole on Aug 01, 2011

The Mobile Minute is back with the latest mobile news. What's happening today? Nielsen Wire looks at smartphone penetration in Asia, RIM lays off 11% of its worldwide workforce, CGAP investigates how network operators can incorporate mobile financial services into their operations, [x]Cube Labs turns Android's history into an infographic, and Read Write Web looks into the latest developments in the use of near field communication technology for mobile payments.

- Curious about the smartphone market in Asia? Nielsen Wire looks at the rapid growth of smartphones in Asia. Although current smartphone penetration in the region is less than 20%, a Nielsen survey of consumers revealed that nearly half of respondents plan to buy a smartphone within the next year. Nielsen Wire investigates what the anticipated increase in smartphone ownership will mean for how people access the Internet, how network operators will price their data plans, and how mobile advertising will adjust to a new market.

- Wired reports that RIM (the makers of BlackBerry devices) announced on July 25th their plans to lay off 2000 employees, roughly 11% of its worldwide workforce. The move comes as RIM has lost market share to the growing popularity of newer operating systems like Apple's iOS and Google's Android.

- CGAP's "How to Run with Mobile Money and Not Fall" article examines how mobile network operators can incorporate mobile financial services into their current business models. Some of the advice for successfully incorporating mobile money services includes using multiple distribution methods (such as both on-phone purchases and traditional street airtime sellers) and getting support from/sharing knowledge among multiple departments.

- If you like charts and graphs, check out this history of the Android operating system. Covering everything from its founding date (2003), to the Google buyout (2005), to the launch of the first Android device (2008), to present day releases, the infographic maps out each update in Android's development.

- Near field communication (NFC) technology allows smartphone users to transmit information to nearby contacts. Read Write Web recently investigated some of the new developments in the NFC field for turning smartphones into credit cards. The first article looks at how the company Isis partnered with four major American credit card companies (Visa, MasterCard, American Express, and Discover) to develop wireless payments. The second article looks at the Jumio payment company's launch of Netswipe, which "turns any webcam into a credit card reader, both on the desktop and on mobile."

[Mobile Minute Disclaimer: The Mobile Minute is a quick round-up of interesting stories that have come across our RSS and Twitter feeds to keep you informed of the rapid pace of innovation. Read them and enjoy them, but know that we have not deeply investigated these news items. For more in-depth information about the ever-growing field of mobile tech for social change, check out our blog posts, white papers and research, how-tos, and case studies.

Image courtesy Flickr user QiFei

Posted by VivianOnano on Jul 01, 2011

Branchless Banking 2010: Who’s Served? At What Price? What’s Next? data sheet 1719 Views

Author:

McKay, Claudia; Picken, Mark

Abstract:

This Focus Note evaluates the evidence from 18 branchless banking providers with a collective total of more than 50 million customers (see Table 1) to answer three questions:

- Does branchless banking reach large numbers of low-income and unbanked clients?

- Are prices for branchless banking lower than prices for traditional banking for the kinds of transactions low-income and unbanked people want to do?

- What other services do these customers want from branchless banking?

The answers to these questions have implications for the business case, customers, and those who hope that branchless banking can boost financial inclusion.

The data offer some answers. On the question of scale, branchless banking can reach large numbers of the unbanked relatively quickly. CGAP looked at the outreach of eight providers globally for which good data were available by drawing on 13 studies that surveyed 16,708 branchless banking clients. The eight providers average 3.73 million active registered users, of which 37 percent or 1.39 million were previously unbanked.Five of the providers reach more previously unbanked clients than the largest microfinance institution (MFI) in the provider’s country—on average, 79 percent more.

These five branchless banking providers grew quickly, surpassing the largest MFI in number of customers within three years. This is not to suggest branchless banking is replacing or eclipsing MFIs. The services branchless banking typically provides (payments) are complimentary to MFI microloans: both meet a widespread need for which clients are willing to pay.

Posted by Juliel on Jun 27, 2011

Financial Education: A Bridge Between Branchless Banking and Low-Income Clients data sheet 938 Views

Author:

Cohen, Monique, Danielle Hopkins and Julie Lee

Abstract:

This paper examines the rapid evolution of branchless banking technologies and development of financial education as a tool to help low-income households better manage their money.

While focusing on getting delivery systems right, promoters of branchless banking often lose sight of the consumer. Despite recent enthusiasm regarding these new banking services, uptake and usage has been limited, and often does not include many of the poor. Reasons for lower usage rates among low-income populations include:

- Lack of familiarity with banking services;

- Limited trust in new financial delivery systems;

- Lack of understanding and experience using the technologies.

However, low-income households are willing to cross the digital divide and conduct their financial transactions through branchless banking. Higher usage is possible, but will require financial education to facilitate this process. This can be delivered through a variety of channels, such as radio, print media and class room training.

Finally, the paper presents a case study from Malawi which demonstrates the viability of branchless banking when potential clients have proper knowledge of how to use it and stresses that well-conceived financial education programs will achieve this aim.

Posted by AnneryanHeatwole on Mar 25, 2011

Today's Mobile Minute brings you coverage on smartphone security and malware, the struggle for mobile money systems in Africa to reach the level of M-PESA in Kenya, Facebook's move toward feature phones, the success of messaging-specific feature phones, and a guide to mobile donations for Japan.

- After more than 50 Android apps were discovered to be carrying malware in early March, the BBC took a look at mobile security. From the risks involved in keeping a lot of personal data on mobiles to ways in which malware can be used to manipulate phones, the article explores the need for mobile security around smartphone applications.

- In Africa, mobile banking has certainly garnered a lot of publicity and press. But All Africa looks at some of the drawbacks of mobile banking in specific countries where mobile banking systems are active; specifically, the article focuses on the "walled garden" system which makes it expensive to transfer funds between different mobile operators (sometimes with fees from five to 20 percent higher than a transfer between two users on the same mobile operator).

- Facebook recently bought Snaptu, a company that develops applications for feature phones. Snaptu developed Facebook's first feature phone app, and Facebook has now reportedly acquired the company for close to $70 million dollars. The purchase could indicate that Facebook plans to focus on reaching non-smartphone users around the world.

- Cellular-News reports that by 2015, messaging-specific feature phones will grow to encompass 1/3 of all shipped feature phones. Feature phones make up 75% of the handset market, and feature phones that are optimized for messaging services (such as "SMS, MMS, mobile email, and mobile IM") are expected to increase in popularity.

- Want to send a mobile donation to a specific cause for tsunami relief in Japan? Into Mobile has a roundup of shortcodes and the organizations that use them so that you can easily find the best way to donate.

[Mobile Minute Disclaimer: The Mobile Minute is a quick round-up of interesting stories that have come across our RSS and Twitter feeds to keep you informed of the rapid pace of innovation. Read them and enjoy them, but know that we have not deeply investigated these news items. For more in-depth information about the ever-growing field of mobile tech for social change, check out our blog posts, white papers and research, how-tos, and case studies.]

Image courtesy Flickr user QiFei

Posted by MarkWeingarten on Jan 28, 2011

The Mobile Money Movement: Catalyst to Jumpstart Emerging Markets data sheet 927 Views

Abstract:

There is something profound taking place in emerging markets with mobile money movement... it is now a “Mobile Money Movement” with the potential to substantially alter the economic paths of the poor and emerging economies at large. For this reason private and public sectors alike are now taking notice of this industry. Mobile finance is becoming an increasingly important topic for The World Economic Forum and for the G20 summit. Nearly 2/3 of the world’s population lives in poverty: four billion people live on less than $8.00 USD per day. Most do not have bank accounts, but do have mobile phones (1.7 billion people by 2012.)

Mobile money provides an opportunity for financial inclusion to the unbanked base of the economic pyramid - the majority of the global population who has lived in the informal financial sector and who has relied on cash to conduct all financial transactions. As such, they lack access to credit, insurance, and savings. This wave of mobile money momentum, if not slowed down by other challenges inherent in these markets, will undoubtedly positively impact the course of economic growth in emerging markets for a number of reasons that are inherent within mobile money itself.

Mobile money will spur economic growth in emerging markets because of the forces inherent to mobile money itself. Specifically, these forces include:

1. the ubiquity of data transmission that mobile provides;

2. mobile money as a new industry;

3. mobile money as an infrastructure supporting new businesses and other industries;

4. the infusion of new capital from the informal sector; and

5. the efficiency gains that digitization of money enables.

Posted by MelissaUlbricht on Jan 19, 2011

At MobileActive.org, we’ve written about initiatives and research in the field of mobile money and mobile banking. It's a burgeoning industry and there is no shortage of relevant projects, services, and advances. Which is why we’re interested in the Mobile Money Toolkit from the International Finance Corporation, a member of the World Bank Group.

We caught up with Margarete O. Biallas of the IFC to learn more about the toolkit and how it can be used by our MobileActive.org readers.

Q: Who would be interested in using the Mobile Money Toolkit?

A: Anyone engaged in providing electronic banking services using mobile technology.

Posted by MarkWeingarten on Jan 13, 2011

Mobile 2.0: M-money for the BoP in the Philippines data sheet 1209 Views

Author:

Alampay, Erwin and Gemma Bala

Abstract:

This paper explores the reach and use of m-money among the bottom of the pyramid (BoP) in the Philippines using survey data from LIRNEasia’s 2008 Mobile 2.0 surveys. It looks at m-money’s potential and actual use for remittance among internal and external migrant workers and their families. The results are triangulated with focus group data and literature on mobile and electronic money, and framed using Van Dijk’s (2006) Stages of Access to digital technologies.

Although usage of m-money among the BoP remains low, the ICT infrastructure for this is in place. Compared to other Asian countries where the survey was also conducted, Filipinos are more familiar and have higher trust in mobile electronic transactions. Managing their resistance to change from current offline remitting practices remains a challenge.

Posted by AnneryanHeatwole on Jan 11, 2011

It's a new year, and the Mobile Minute is back to bring you the latest. We've got coverage on doctors using mobile money for bus fares for fistula patient, Britain's minister of civil society questioning Apple's no-donation apps policy, the BBC's coverage on how hackers can eavesdrop on GSM calls, the California Supreme Court's ruling that police can search the cell phones of arrested people without a warrant, and CGAP's look at current, non-mobile money transfer systems in Haiti.

Posted by MohiniBhavsar on Nov 10, 2010

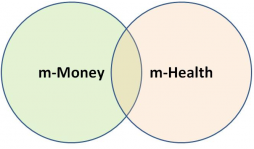

In this two-part series, MobileActive.org explores how mobile money services can support health care in developing countries. In part one, we described the key ways in which mobile money services can be adopted by the health sector.

At the primary level of care, subscription-based mobile payment services can create two-way links between patients and health care providers, as summarized here.

- Patients can pay service providers directly for health care services delivered.

- Service providers can use mobile transfer platforms to reward patients with monetary or airtime incentives for treatment compliance.

At the district, regional, and national levels, governments and organizations can improve management of funds and introduce better checks and balances by using mobile money platforms. Some uses include:

Posted by KatrinVerclas on Nov 01, 2010

Is mobile money living up to the hype? Does it provide more and better financial services for low-income and poor people? Our great friends over at CGAP, the definitive source on credible research on mobile money and branchless banking, have gathered data on 16,000 mobile money customers in seven coutries to understand better how far branchless banking is reaching the unbanked. The results are published in a new CGAP paper.

As fas as we know, this is the first time such an extensive data set has been collected. It sought to answer three questions: Is mobile banking reaching poor customers? Is it more affordable than traditional banking? And lastly, do customers get what they want?

The CGAP researchers looked at 18 branchless banking providers with more than 50 million customers in 10 countries. What did they find?

Posted by AnneryanHeatwole on Oct 05, 2010

Today's Mobile Minute is focused on mobile money. We've got news about Bharti's financial services in India, Rwanda's new mobile banking guidelines, Digicel's plan for mobile financial services in Haiti, ICT growth from 1998 to 2009, and the popularity of native apps on smartphones.

- Digicel, a Caribbean telecom, announced they will launch a mobile banking pilot project in Haiti, starting this October. The pilot will allow users to transfer funds and give and receive cash via mobiles.

- ICT4Dblog charted how ICTs have grown around the world, ranking mobile, Internet, and broadband growth over an 11-year period. The site then looked at how these numbers show the digital gap between rich and poor countries, and then reported on: "digital lag: the time gap between a given average ICT penetration level in the poorest countries, and the year that was achieved in the richest countries. Current digital lag is just under 10 years for mobile, and something like 14-15 years for Internet. For broadband, it’s just over 10 years but the figures are so low that this may not be meaningful."

[Mobile Minute Disclaimer: The Mobile Minute is a quick round-up of interesting stories that have come across our RSS and Twitter feeds to keep you informed of the rapid pace of innovation. Read them and enjoy them, but know that we have not deeply investigated these news items. For more in-depth information about the ever-growing field of mobile tech for social change, check out our blog posts, white papers and research, how-tos, and case studies.]

Image courtesy Flickr user QiFei

Posted by AnneryanHeatwole on Aug 12, 2010

Today's Mobile Minute covers the unfolding BBM security controversy, Ushahidi's new Crowdmap online platform, a roundup of mobile apps for the disabled, a break down of what mobile ownership numbers actually mean, and the take-away on mobile remittances from the Tech@State conference.

Posted by AnneryanHeatwole on Feb 23, 2010

Cash Transfers through Mobile Phones: An Innovative Emergency Response in Kenya data sheet 3715 Views

Author:

Dipankar Datta, Anne Ejakait, Kim Scriven

Abstract:

Kenya was one of the first countries to use mobile phones for cash transfers; through a service called M‐PESA, developed by Safaricom Limited. Concern Worldwide has pioneered the use of M‐PESA for emergency cash transfers in Kenya. This paper highlights Concern’s experience, which shows that despite initial software and logistical challenges, mobile phone technology offers a unique and empowering approach to efficiently deliver assistance to the most vulnerable people living in insecure and remote rural areas.

Experience also shows that cash transfers are a better option than food distributions in areas where adequate supplies of food are locally available. In addition, the partnership between Concern and Safaricom demonstrates that the private sector has significant and unique abilities to enhance the effectiveness of emergency response, and more importantly they can do so while maintaining their core business principles. The case study also demonstrates how technology can empower poor, marginalised and vulnerable people.

Posted by AnneryanHeatwole on Nov 03, 2009

What Makes a Successful Mobile Money Implementation? Learnings from M-PESA in Kenya and Tanzania data sheet 4402 Views

Author:

Gunnar Camner, Emil Sjoblom, Caroline Pulver

Abstract:

This review considers the differences between the adoption rates of M-PESA in Kenya and Tanzania and tries to highlight some of the reasons that the same service launched in seemingly similar countries has yielded such different results. This paper is intended as a discussion document for mobile network operators considering launching a mobile money service.

Safaricom launched M-PESA in Kenya in March 2007 and has since become the most famous and probably the most successful implementation of mobile money service to date. In May 2008, 14 months after the launch, M-PESA in Kenya had 2.7 million users and almost 3,000 agents. Today, over two years since its launch, M-PESA has gained 7 million registered customers and has 10,000 agents spread across the country. This exceeds the reach of any other financial service in Kenya.

Finaccess 2009 showed that M-PESA has become the most popular method of money transfer in Kenya with 40% of all adults using the service. The same Kenyan survey also shows a dramatic increase in national remittances; from 17% in 2006 to 52% in 2009, which may be attributed to the ease of money transfer through ubiquitous M-PESA agents. Many mobile network operators have been eager to repeat M-PESA’s success in Kenya, but the formula for this success is not yet clear. One year after the Kenyan launch, Vodacom launched M-PESA in April 2008 in Tanzania. The user uptake of the service in Tanzania has been much slower compared to its northern neighbour. In June 2009, 14 months after the launch, M-PESA in Tanzania had 280,000 users and 1,000 agents (Rasmussen 2009).